Charge GST at 0 only if it falls within the description of international services under Section 21 3 of the GST Act. The Service tax is also a single-stage tax with a rate of 6.

Salient Features Of Gst Matta Date 28 April 2014 Place Vivatel Hotel Ppt Download

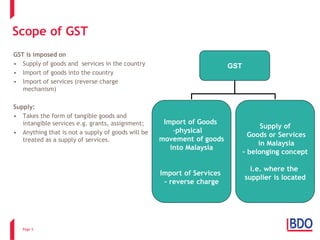

SCOPE OF TAX 3.

. As such the rate reduction from the current 6 to 0 will be reflected on transactions related to MYXpats charges from 1 June 2018 onwards. The much sought after details and scope of the Goods and Services Tax GST have been released by the Custom Department. Company A then sells the goods to Company B which received the goods within the FTZ.

Besides the General Guide on GST industry guides are also made available specifically to provide guidance to businesses and organizations operating in specific industries. STANDARD RATED 6 28 Manufacturer Wholesaler 6 6 6. GST Tax Codes for Supplies.

It is now refers to Total Value of Other Supplies that comprises of tax codes. You can zero-rate your supply of services ie. Organizations prepare for GST implementation in Malaysia.

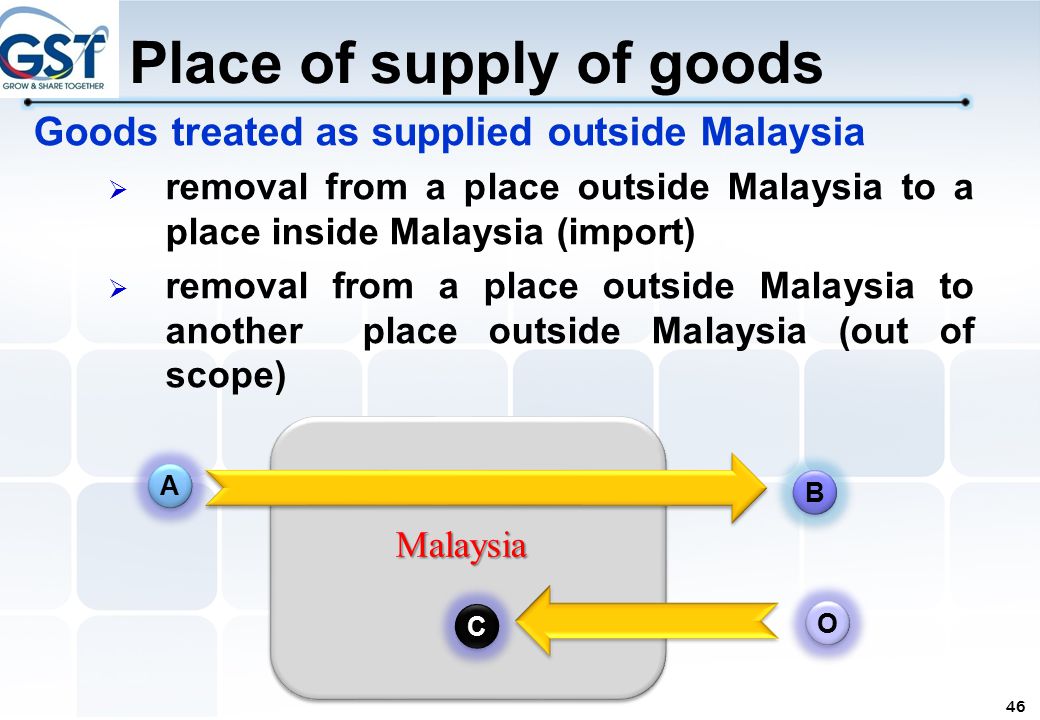

Download form and document related to RMCD. The sale of goods is an out-of-scope supply and the supply is not subject to GST. HISTORY OF GST IN MALAYSIA.

This tax is not required for imported or exported services. For instance the supply of the goods sold in Singapore but are manufactured in some other country will be known as out-of-scope supply. No GST will be imposed on the supply made by the Federal Government and State Government such as healthcare services provided by hospital and.

Goods that are not made in the country in which they are sold are termed as out-of-scope supplies. Company A has imported goods from overseas and stored them in the FTZ. It is important to note that not all services provided to overseas customers can be zero-rated.

In the service tax no input exemption mechanism is. Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business. GST shall be levied and charged on the taxable supply of goods and services.

A taxable supply is a supply which is standard rated or zero rated. However the extent to which this may increase the price of goods remains to be seen and may be somewhat mitigated depending on the scope of tax exemptzero-rated goods. Here is the a potential list of out of scope supplies to be disclosed.

GST code Rate Description. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 TX. This is some text inside of a div block.

GST is also charged on the importation of goods and services. Where an invoice is received after 01 June 2018 for services rendered prior to 01. Supplies not within the scope of GST Supplies which do not fall within the charging provision of the GST legislation include non-business transactions sales of goods from a place outside Malaysia to another place outside Malaysia employment income and penalties.

Tax Code Mapping to GST-03 Box 15. Supplies made by the Government are generally treated as out of scope supplies. The current sales tax and service tax will be abolished and be replaced by a consumption tax based on the value-added concept known as Goods and Services Tax GST.

GST will not be imposed on piped water and first 200 units of electricity per month for domestic. The supplies of such goods are out of scope GST and for that reason. The implementation of the goods and services tax gst on april 1 2015 and its abolishment three years later probably makes it one of the most if not the most controversial tax to be introduced in malaysias historythe gst was also highly politicised abolishing it was the numero uno promise of the pakatan harapan government in its election manifesto on.

The Royal Malaysian Customs Department RMCD has already commenced GST closure audits even arranging for tax professionals to conduct some audits for and on their behalf. From 01 June 2018 GST should be charged at standard rate of 0 on the difference between the total value of the supply and the value of the supply before 01 June 2018. Here is A List of Potential Out of Scope Supplies.

OS OS-TXM GS NTX and SR-JWS. For more information regarding the change and guide please refer to. An expert in taxation has recommended that the goods and services tax GST be re-introduced only.

GST in Malaysia will be implemented on 1 April 2015 as announced by the Prime Minister cum Minister of Finance during the 2014 Budget. The Goods and Services Tax GST will be set to zero percent 0 effective from 1 June 2018 as announced by the Ministry of Finance Malaysia on 16 May 2018. Malaysia GST Reduced to Zero.

GST will be implemented from 1 April 2015. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent. Out of Scope GST Rate Claimable 6 0 --GST MECHANISM CONTD HOW GST WORKS.

Currently Sales tax and service tax rates are 10 and 6 respectively. 000 134. With a target to close all GST audit-related activity by the end of 2019 its unlikely that all 480000 GST registrants will be audited.

Jabatan Kastam Diraja Malaysia. This preview shows page 23 - 25 out of 39 pagespreview shows page 23 - 25 out of 39 pages. These are standard-rated supplies exempt supplies zero-rated supplies and supplies that are beyond the scope of Goods Services Tax.

In Malaysia GST largely falls under 4 different categories. Overview of Goods and Services Tax GST in Malaysia. Out of scope purchases.

Sales tax and service tax will be abolished. It has been reported that businesses in Malaysia have spent almost RM15 billion to implement GST systems that have been in use for less than four years8. However it may change from time to time.

Other Related Guides 2. GST should be accountable at standard rate 6 on the value of supply up to 31 May 2018. In addition the provision of services by the Government is also out of scope.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. Goods services that fall under each of these categories are pre-determined by the RCDM Royal Custom Department of Malaysia. GST shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person.

Exempt and out of scope supplies are not taxable supplies. When the goods are subsequently removed from the FTZ by Company B GST may be chargeable. This section will explain to you the scope of GST in Malaysia.

How To Start Gst Get Your Company Ready With Gst

Gst Is Not New The Concept Behind Gst Was Invented By A French Tax Official In The 1950s In Some Countries It Is Known As Vat Or Value Added Tax Today More Than 160 Nations Including The European Union And Asian Countries Such As Sri Lanka

Countries Implementing Gst Or Vat

Pdf The Relationship Between Tax Evasion And Gst Rate

Session Malaysias New Gst Business Change With Tax

Session Malaysias New Gst Business Change With Tax

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Gst Tax Codes Rates Myobaccounting Com My

Gst Requirements Penalties In Malaysia Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Maldives In Imf Staff Country Reports Volume 2019 Issue 196 2019

Uparrow Malaysian Gst Enhancement 1st Phase Implementation Home Gst Malaysian Gst Enhancement 1st Phase Implementation September 24 2014 Mohd Imran Gst No Comments Contents Hide 1 Introduction 2 Activating Gst Functions 3

Salient Features Of Gst Matta Date 28 April 2014 Place Vivatel Hotel Ppt Download

Scope Of Goods Services Tax Gst Goods Services Tax Gst Malaysia Nbc Group